I recently had occasion to reread an article from 2021 by Jude Clemente, a contributor to Forbes and the Principal at JTC Energy Research Associates, LLC. The article contains an excellent analysis of the benefits of fracking and the problems with the arguments against it. The article is entitled “Why Do ‘Fracking’ Opponents Ignore Its Moral Benefits” and you can read it here. The article is well researched, and I recommend it to any of you interested in the pros and cons of fracking, regardless of your personal view.

Articles Posted in Oil and Gas News

The Myth of Restarting Domestic Oil & Gas Production

You can’t watch a newscast these days without seeing a Senator or Congressman or some other talking head insist that the actions of the current Administration in curtailing domestic oil and gas production and pipelines were unwise and that oil and gas production must be restarted immediately.

The posture of the current President towards domestic oil and gas production has certainly been irrational, to say the least. In attempting to appease the far left of the Democratic Party, Biden has not only crippled energy production, he has created devastating inflation and a critically dangerous national security situation. Oil and gas is not just essential for transportation, it is a component of many of the products we use on a daily basis. In addition, people may not realize that natural gas is essential for creating fertilizer. American farmers have begun publicly warning of food shortages beginning this summer and fall because of the inability to obtain fertilizer. Since Biden is doing this while importing Russian oil and refusing to ban the import of Russian oil as a sanction for the Russian invasion of Ukraine, one might logically ask just who side he is on?

The problem is that even if Biden woke up tomorrow and removed all the impediments to domestic oil and gas production, there is no switch that gets thrown which results in sudden production. Instead, there is a substantial lead time to bring wells back online and into production. Drilling new wells, especially horizontal wells, takes time. More importantly, domestic oil and gas producers don’t trust the dementia-fueled irrationality of Biden and his advisors. They are not going to incur the considerable expense of drilling new wells, much less bringing existing wells back online, until there is someone with a logical and coherent and rational energy policy in the White House. Finally, even if and gas wells were to be allowed to be restarted and new wells could be drilled, we do not have sufficient pipeline capacity to get the oil and gas to refineries.

Unintended Consequences of Eliminating Oil and Gas

As anyone who reads my blog is aware, I am a Texas oil and gas attorney who only represents mineral, royalty and surface owners and I never represent oil companies. My passion has always been helping land and mineral owners make the best use of their land and mineral assets and get the best compensation and terms for leases, pipeline and utility easements and surface use agreements. However, the current political discussions regarding the oil and gas industry seem to disregard some important facts that we may all want to keep in mind.

The oil and gas industry has been the subject of many public discussions, and that is a good thing. Regardless of your political view, the suggestions that we eliminate fracking, limit oil and gas production offshore and on federal lands, transition away from oil and gas and remove what have been called “subsidies” to the oil and gas industry, involve a number of potential unintended consequences that we all should be aware of. These include:

- All the plastics and a number of medicines in our life are derived from oil and gas. Without petroleum, there will be no cell phones, computers, appliances, cars and many other items that we use in our daily life. (Maybe that’s a good thing!). If the supply of oil and gas becomes limited, all these things will become more expensive.

Unintended Consequences of Canceling the Keystone Pipeline

As most people are aware, President Biden has canceled the permit for the Keystone pipeline with one of his first executive orders. While environmental interests certainly applaud this move, there will be consequences that politicians may not be taking into account.

First, without the pipeline, oil will need to be moved by railroad cars and trucks. Both of these methods involve a greater rate of accidents and spills than the pipeline.

Secondly, using rail and trucks to move oil will result in an increase in carbon emissions compared with the pipeline.

Texas and U. S. Drilling Rig Count is Going Up

In a bit of welcome news for Texas mineral owners, according to the metrics calculated by Baker Hughes, the oil and gas drilling rig count for Texas and the United States is going up. Specifically, the rig count has gone up by 13 rigs since October 9, 2020. This represents the fifth week in a row that there has been an increase in the rig count. This past week has represented the largest increase since January 2020. Of course, there has been a decrease of 569 rigs since October 2019, so there is a ways to go.

Over half of the rigs have been added in Texas and especially in the Eagle Ford Shale.

The downward pressure on oil and gas prices due to the OPEC/Russian price war and the erosion of demand due to the covid virus has decimated oil prices, although they currently seen to be holding steady at about $40 per barrel for oil, according to the Energy Information Administration. In September, the Henry Hub natural gas spot price averaged $1.92 per million British thermal units (MMBtu), down from an average of $2.30/MMBtu in August, 2020.

U.S. Energy Information Administration Report on Wolfcamp Shale Play in Permian Basin

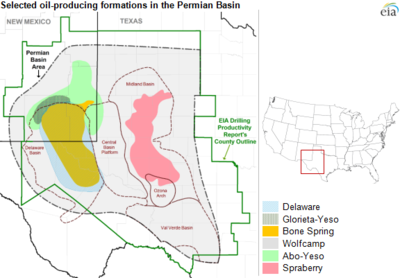

In August 2020, the Energy Information Administration (EIA) issued the second part of its report on the Wolfcamp shale play of the Midland sub-basin section of the Permian Basin, which you can read here. The report is an interesting analysis of the geology of this area. The accumulations in the Permian Basin that became hydrocarbons were deposited during the Pennsylvanian through the late Wolfecampian geologic era while an inland sea covered this area.

As many of you know, the Permian Basin has been producing for about 100 years. So far, it has produced more than 35.6 billion barrels of oil and about 125 trillion cubic feet of natural gas. Last year, this area accounted for more than 35% of total U.S. crude oil production. The EIA estimates that its reserves of oil and gas make the Permian one of the largest hydrocarbon producing basins in the world.

The Permian Basin contains three sub-basins: the Delaware, Central and Midland. The Wolfcamp play extends in the subsurface of all three of these sub-basins. It has been called the most prolific oil and gas bearing formation within the Permian Basin. The Wolfcamp formation is, in turn, divided into four sections, or benches, designated by A, B, C and D. Each bench differs in a number of ways, including its porosity and organic content. Since many areas of this play have very low permeability, production often requires multistage hydraulic fracturing.

New Book by Daniel Yergin

There is a new book out in September 2020 by Daniel Yergin. As some of you know, he is the author of The Prize (which won a Pulitzer Prize) and The Quest, both of which are essential reading for anyone seeking an understanding of the history and nature of the oil and gas industry. The new book is entitled: The New Map: Energy, Climate, and the Clash of Nations, and will no doubt be just as interesting as his previous books.

Some of the points he addresses in the new book are:

- the future of the shale boom

Texas and US Shale Production Coming Back

Many Texas mineral interest and royalty owners have seen their royalty checks shrink or disappear altogether in the second quarter of 2020. The covid crisis caused prices to slip to nearly zero in some cases and in response, in April, May and June 2020, many operators shut in wells that they could no longer afford to operate. There was concern among some in the oil and gas industry that shutting in these wells could cause permanent damage to the wells and/or the reservoirs.

It now appears that those fears were probably unfounded. A recent press release by Rystad Energy, based on an analysis of second quarter earnings reports from 25 large, publicly traded oil companies, reports that most US onshore operators will restore nearly all shut-in oil wells by the end of the third quarter of 2020. This has no doubt been driven by the partial rebound in oil prices. The operators sampled said they did not face any issues in bringing wells back online. Rystad Energy’s Vice President for North American Shale and Upstream, Veronika Akulinitseva, said “No loss of production has been reported by any operator following the shut-ins and moderation of output, with most companies flagging a smooth return of operations, and in some cases posting a positive production impact from those reactivations”. One operator, EOG Resources, indicated that nearly all their reactivated wells have exhibited some degree of “flush production”. Flush production is an increase in production after a well is reactivated because the bottom hole pressure has been building up while the well was shut in.

Many Texas mineral and royalty owners are individuals who depend on their monthly royalty check to pay the bills. The reactivation of these wells, and the larger royalty checks for a month or so, will be good news to these owners. In addition, as production comes back, oil companies will begin to add back laid off employees, which is important to those families and also to the Texas economy as a whole.

The Ripple Effect of Texas Oil Company Bankruptcies

As oil prices have declined to unprecedented lows, consumers may feel glad for lower gasoline prices at the pump. However, the piper always has to be paid, and nowhere more so than in Texas.

As I discussed in a previous post, oil companies have been hit by a number of negative factors, some of their own making. First, our country was experiencing a substantial oversupply of oil going into the current situation. Many oil companies continued to produce, despite the oversupply, because increased production resulted in higher stock prices which in turn resulted in higher bonus for officers of the oil company. To this extent, some oil companies have brought this situation upon themselves. Secondly, the production war between Russia and Saudi Arabia exacerbated the oversupply and helped drive the price of oil down. Third, as the price of oil declined, the value of individual oil company’s reservoirs declined. In the cases where reserves were used as collateral for loans, the bank would then require either repayment of at least a portion of the loan or new collateral for the loan. Oil companies that cannot comply default and/or file bankruptcy. Fourth, the covid 19 virus creates staffing issues for oil companies, both in their offices and in the field. Fifth, shelter in place orders have resulted in drastically reduced demand for oil and gas. Finally, all of these factors make lenders and investors very nervous and so new money for exploration, production and pipelines is becoming more scarce.

Not surprisingly, all of this has resulted in oil company bankruptcies. So far, since January 2020, several oil companies have filed for bankruptcy protection: Bridgemark Corporation, Southland Royalty Company LLC, Dalf Energy LLC, Sheridan Holding Company I LLC (who are actually an investment fund), Echo Energy Partners I LLC, Whiting Petroleum Company, Victerra Energy LLC, Gavilan Resources LLC, Ultra Petroleum and Sklar Exploration Company LLC. Other companies, including Chesapeake Energy Corporation and Denbury Resources, are reportedly preparing bankruptcy filings. There been some predictions that hundreds of oil companies will file bankruptcy by the end of 2021.

Texas General Land Office Announces Covid Policy

The Texas School Land Board announced new policies in response to the covid pandemic. These policies apply to Texas Permanent School Fund (PSF) lands that are subject to the Texas Relinquishment Act, Texas Natural Resources Code 52.171 through 52.190. According to the General Land Office (GLO) website: “The policies delegates the Land Commissioner the authority to grant up to a six-month extension on all drilling commitments, when it’s deemed to be in the state’s best interest, made by lessees of permanent school fund property during 2020, and a 90-day tolling on calculations for enforcing lease terminations for halting of production or failure to produce in paying quantities. Additional actions include adopting a policy addressing a waiver of penalties and interest on late royalty payments submitted from April 1, 2020 through June 30, 2020 in light of the current oil and gas crisis facing the nation.”

Owners of school lands who observe operators on their property who are not drilling or who have producing wells on their property that have ceased production, need to be aware that the cessation of drilling or production may not be a default under the lease, at least until the grace period imposed by the GLO has expired. Keep in mind that, given the other pressures the oil industry is suffering from at the moment, it would not be surprising to see these waivers extended.

Texas Oil and Gas Attorney Blog

Texas Oil and Gas Attorney Blog