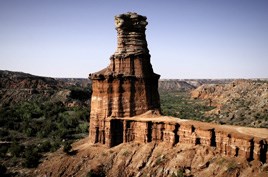

Texas tops the list of most attractive jurisdictions for petroleum exploration and production investment, while Oklahoma leads the world with the most desirable policy environment, according to the annual Global Petroleum Survey compiled by the Fraser Institute.

The survey attempts to provide information about perceptions affecting investment decisions, including those on tax rates, regulatory obligations, uncertainty over environmental and other administrative regulations, as well as concerns regarding political stability and the security of personnel and equipment. These perceptions were assessed via a survey evaluating 157 jurisdictions, and compiled into the Fraser Institute’s Policy Perception Index.

In order, the jurisdictions perceived as having the policy environment most favorable to petroleum exploration and production investment are Oklahoma, Mississippi, Saskatchewan, Texas, Arkansas, Kansas, Alabama, North Dakota, Manitoba, and the Netherlands/North Sea. The jurisdictions perceived as the worst for petroleum exploration and production investment are Russia (except Offshore Arctic, Offshore Sakhalin, and Eastern Siberia), Iraq, South Sudan, Russia/Eastern Siberia, Uzbekistan, Russia/Offshore Arctic, Bolivia, Iran, Ecuador, and Venezuela.

In order, the jurisdictions perceived as having the policy environment most favorable to petroleum exploration and production investment are Oklahoma, Mississippi, Saskatchewan, Texas, Arkansas, Kansas, Alabama, North Dakota, Manitoba, and the Netherlands/North Sea. The jurisdictions perceived as the worst for petroleum exploration and production investment are Russia (except Offshore Arctic, Offshore Sakhalin, and Eastern Siberia), Iraq, South Sudan, Russia/Eastern Siberia, Uzbekistan, Russia/Offshore Arctic, Bolivia, Iran, Ecuador, and Venezuela.

To correlate policy perceptions with geologic desirability, the Fraser Institute sorts jurisdictions into tiers. Texas leads the pack in Tier One, the category of jurisdictions that hold at least one percent of the world’s total proved oil and gas reserves. Following Texas in the first tier are Qatar, Alberta, the United Arab Emirates, and Norway/North Sea. The least favorable policy environments among jurisdictions in Tier One are Iraq, Russia – East Siberia, Russia/Offshore Arctic, Iran, and Venezuela. The most favorable jurisdictions in Tier Two, or jurisdictions containing between 0.1% and 1% of the world’s proved oil and gas reserves, are Oklahoma, Arkansas, North Dakota, the Netherlands, and Louisiana. The least favorable jurisdictions in Tier Two are Ukraine, South Sudan, Uzbekistan, Bolivia, and Ecuador. In Tier Three, or jurisdictions with very little proved oil and gas reserves, the most attractive policy environments were found to be in Mississippi, Saskatchewan, Kansas, Alabama, and the Netherlands/North Sea, while the least attractive in Tier Three are Argentina, Kyrgyzstan, Somaliland, and Guatemala.

The Global Petroleum Survey is in its seventh year, and the data collected is also used by the Institute to track trends in perception. Perception of barriers to investment have increased in jurisdictions including Colorado and New Mexico, jurisdictions that have seen political subdivisions implement hydraulic fracturing bans in the last year, as well as in California, where there is a growing popular sentiment in favor of a fraccing ban. Several jurisdictions improved their policy perceptions dramatically, including Chile, Jordan, Mali, and Pakistan. In North America, New Brunswick was the most improved jurisdiction.

Additional questions in the survey asked how respondents perceptions might change as a result of policy changes in the US and Canada. Specifically, the survey asked respondents how they would change their assessment of investment potential if the United States implemented federal control of hydraulic fracturing. Slightly more than half of the survey respondents said such a change would negatively affect their assessment of the policy environment in US jurisdictions, while a quarter of respondents would not change their assessment. Respondents were also asked how their assessment of Western Canada and the Northwest Territories would change if Canada continues to face difficulties in creating sufficient infrastructure to transport oil out of the region. More than two thirds of the respondents said it would negatively affect their opinion of investment opportunities in the region, while a third responded that it would not change their assessment.

Considering the trends over the last few years, those of us working in the Texas oil and gas industry are not surprised to see our state fare so well in this petroleum exploration and production investment study.

Texas Oil and Gas Attorney Blog

Texas Oil and Gas Attorney Blog